Facts and figures

Structure

The CENIT share opened the 2025 trading year at € 7.40 and closed the year at € 7.34. The average daily trade volume on all German stock exchanges over the last 52 weeks came to 7,005 shares a day. The average selling price for 2025 was € 7.679, with a 52-week high of € 9.56 and a low of € 6.00. In total, around 1,550,000 shares were traded (XETRA). Due to the high free float percentage, only approximate data can be provided on shareholder structure, resulting in the following overview of the size and composition of the group of shareholders. The CENIT share is listed on the Prime Standard of the German Stock Exchange and fulfils applicable international requirements on transparency.

Equity subject to reporting/disclosure

|

Company |

Declared on |

Shares |

% |

|---|---|---|---|

|

PRIMEPULSE SE |

11.08.2021 |

2,092,950 |

25.01 |

|

Baden-Württembergische Versorgungsanstalt für Ärzte, Zahnärzte und Tierärzte |

17.05.2024 |

469,666 |

5.61 |

|

Universal-Investment-GmbH |

05.08.2025 |

421.000 |

5.03 |

General Data

|

Total revenue |

EBITDA |

EBIT |

Net Income |

EPS in € |

Dividend / share in € |

Equity ratio in % |

Employees |

No. of shares |

|

|---|---|---|---|---|---|---|---|---|---|

|

2024 |

207.33 |

17.26 |

7.38 |

-1.57 |

-0.23 |

30.03 |

984 |

8,367,758 |

|

|

2023 |

184.72 |

16.41 |

9.22 |

4.92 |

0.54 |

0.04 |

29.3 |

893 |

8,367,758 |

|

2022 |

162.15 |

11.94 |

6.31 |

6.61 |

0.75 |

0.50 |

35.3 |

861 |

8,367,758 |

|

2021 |

146.07 |

11.27 |

6.23 |

4.35 |

0.51 |

0.75 |

47.0 |

685 |

8,367,758 |

|

2020 |

142.13 |

9.59 |

3.63 |

2.92 |

0.28 |

0.47 |

51.2 |

711 |

8,367,758 |

|

2019 |

171.71 |

15.24 |

9.20 |

6.96 |

0.82 |

45.80 |

737 |

8,367,758 |

|

|

2018 |

169.99 |

11.95 |

9.03 |

6.13 |

0.73 |

0.60 |

49.40 |

757 |

8,367,758 |

|

2017 |

151.70 |

15.27 |

12.84 |

8.99 |

1.07 |

1.00 |

46.80 |

764 |

8,367,758 |

|

2016 |

123.77 |

14.06 |

11.85 |

8.15 |

0.97 |

1.00 |

56.20 |

615 |

8,367,758 |

|

2015 |

121.47 |

12.69 |

10.60 |

7.31 |

0.87 |

1.00 |

59.60 |

628 |

8,367,758 |

|

2014 |

123.39 |

11.66 |

9.33 |

6.36 |

0.76 |

0.90 |

58.80 |

659 |

8,367,758 |

|

2013 |

118.92 |

10.63 |

8.33 |

5.88 |

0.70 |

0.35 |

59.50 |

671 |

8,367,758 |

|

2012 |

118.85 |

11.04 |

8.02 |

5.42 |

0.65 |

0.55 |

58.70 |

675 |

8,367,758 |

|

2011 |

107.84 |

8.74 |

6.26 |

4.35 |

0.52 |

0.30 |

57.00 |

657 |

8,367,758 |

|

2010 |

93.17 |

5.74 |

3.97 |

3.01 |

0.36 |

0.15 |

58.00 |

634 |

8,367,758 |

|

2009 |

86.49 |

5.29 |

3.89 |

2.72 |

0.33 |

0.30 |

64.00 |

695 |

8,367,758 |

|

2008 |

83.36 |

6.19 |

4.78 |

3.33 |

0.40 |

64.00 |

721 |

8,367,758 |

|

|

2007 |

77.06 |

9.45 |

8.36 |

6.12 |

0.73 |

0.50 |

72.00 |

636 |

8,367,758 |

|

2006 |

82.36 |

11.14 |

10.19 |

8.40 |

1.00 |

0.50 |

62.00 |

576 |

8,367,758 |

|

2005 |

74.30 |

10.23 |

9.41 |

6.75 |

1.61 |

0.90 |

58.00 |

523 |

4,183,879 |

|

2004 |

74.91 |

8.19 |

7.53 |

3.90 |

0.93 |

0.30 |

49.00 |

466 |

4,183,879 |

|

2003 |

70.48 |

3.55 |

2.48 |

1.74 |

0.41 |

41.40 |

442 |

4,183,879 |

|

|

2002 |

94.00 |

2.26 |

-5.36 |

-7.39 |

-1.77 |

30.06 |

558 |

4,183,879 |

|

|

2001 |

118.90 |

-2.87 |

-7.80 |

-13.67 |

-3.28 |

34.50 |

649 |

4,183,879 |

|

|

2000 |

118.55 |

5.15 |

1.30 |

-0.60 |

-0.15 |

51.95 |

870 |

4,183,879 |

|

|

1999 |

79.50 |

7.49 |

3.21 |

5.90 |

0.80 |

0.25 |

61.44 |

440 |

4,000,000 |

|

1998 |

61.60 |

4.39 |

3.18 |

2.31 |

0.40 |

0.51 |

62.60 |

315 |

1,000,000 |

Directors' dealings disclosures

Pursuant to Section 15a Para 4 of the German Securities Trading Act, CENIT AG is required to immediately disclose notifications provided by Management and Supervisory Board members, as well as people closely associated with them, regarding directors' dealings with shares of the company or related financial instruments.

2025

15.09.2025: Peter Schneck, Member of the Management Board, Buy (Tradegate, XETRA, Stuttgart): 4,712 shares, Price 7.380 EUR, Total volume EUR 34,807.60 EUR

21.08.2025: Dr. Johannes Fues, Member of the Management Board, Buy (Tradegate): 3,378 shares, Price EUR 7.4142, Total volume EUR 25,045.14

2024

05.08.2024: Peter Schneck, Member of the Management Board, Buy (Tradegate): 2,500 shares, Price EUR 12.0255941, Total volume EUR 30,063.97

02.01./03.01.2024: Axel Otto, Member of the Management Board, Buy (Tradegate): 18,500 shares; Price: €12.8181; Total volume: 238,420.00 EUR

2023

05.10.2023: Peter Schneck, Member of the Management Board, Buy (FRANKFURT): 11,788 shares; Price: €12.7861; Total volume: €150,722.15

2017

29.05.2017: Andreas Schmidt, Chairman of the Supervisory Board, Sell (OTC): 20,000 shares; Price: €22.20; Total volume: €444,000

2015

16.12.2015: Andreas Schmidt, Chairman of the Supervisory Board, Sell (OTC): 3,000 shares; Price: €21.35; Total volume: €64,050

11.12.2015: Andreas Schmidt, Chairman of the Supervisory Board, Sell (OTC): 5,000 shares; Price: €21.55; Total volume: €107,750

22.06.2015: Andreas Schmidt, Chairman of the Supervisory Board, Sell (OTC): 75,000 shares; €15.50; Total volume: €1,162,500

2013

10.10.2013: Matthias Schmidt, Member of the Management Board, Buy (XETRA): 670 shares; Price: €9.00; Total volume: €6,030.00

2012

02.08.2012: Christian Pusch, Member of the Management Board, Sell (XETRA): 8,000 shares; Price: €6.76; Total volume: €54,080.00

2011

03.05.2011: Andreas Karrer, Member of the Supervisory Board, Buy (STUTTGART): 1,000 shares; Price: €5.49; Total volume: €5,490.00

21.04.2011: Christian Pusch, Member of the Management Board, Buy (XETRA): 8,000 shares; Price: €5.174; Total volume: €41,392.00

21.04.2011: Kurt Bengel, Member of the Management Board, Buy (XETRA): 6,000 shares; Price: €5.19; Total volume: €31,140.00

2007

20.02.2007: Andreas Schmidt, Member of the Management Board until 31 July 2007, Sell (OTC): 100,000 shares; Price: €13.00; Total volume: €1,300,000.00

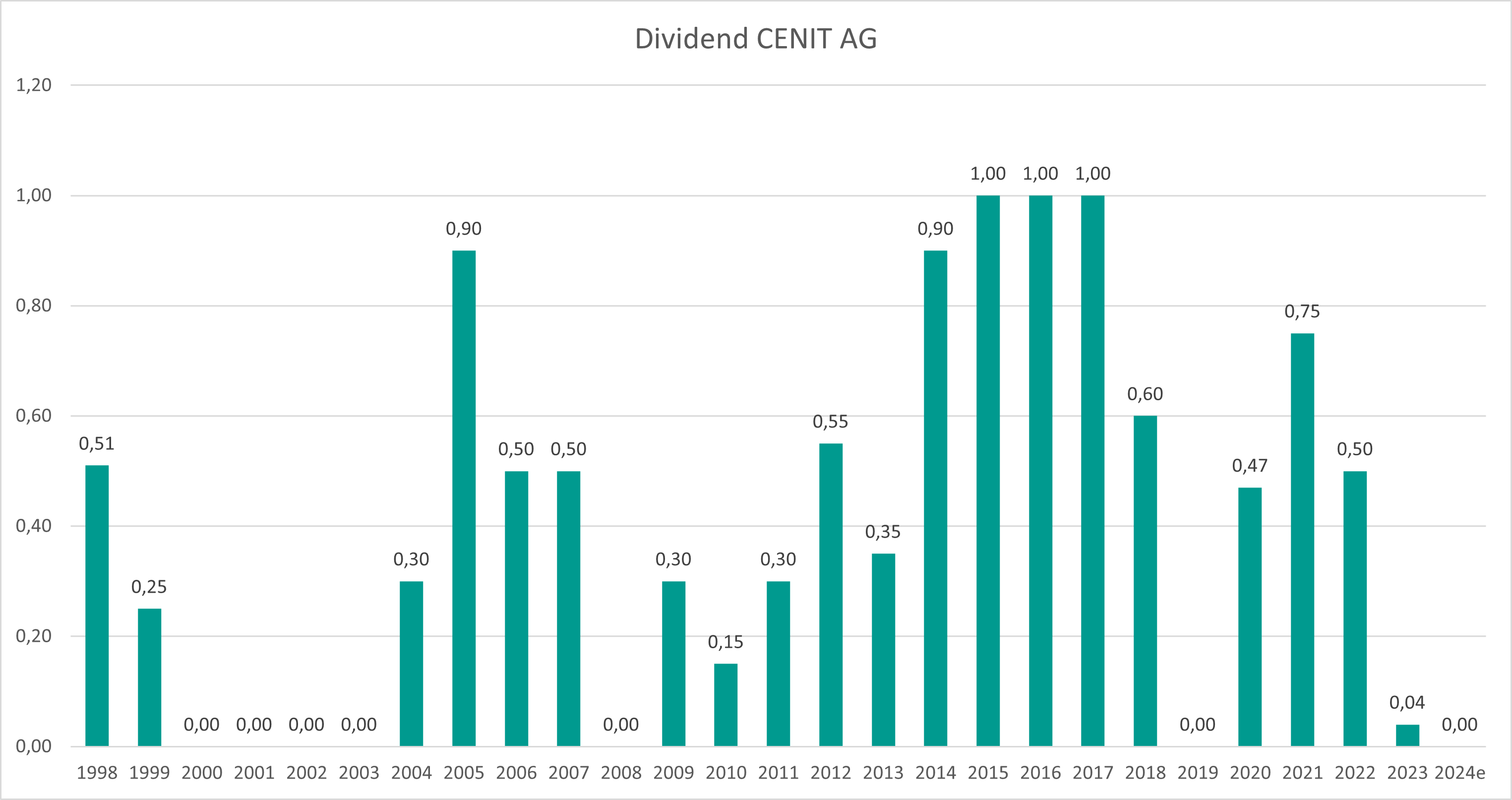

Dividend

Analyst ratings

|

Institute |

Rating |

Price target (EUR) |

Date |

|---|---|---|---|

|

GBC |

Buy |

16,00 |

08/06/2025 |

|

montega |

Buy |

14,00 |

07/11/2025 |

|

Hauck & Aufhäuser |

Buy |

17,20 |

05/26/2025 |

|

Warburg Research |

Buy |

11,00 |

07/31/2025 |

|

Metzler |

Buy |

13,00 |

07/29/2025 |

Research reports on CENIT are currently being published by five banks and analyst organisations. These are recommendations from Hauck & Aufhäuser Investment Banking Privatbank AG, Hamburg, Warburg Research GmbH, Hamburg, GBC AG, Augsburg, Stifel Europe Bank AG, Frankfurt and Montega AG, Hamburg.

Hauck & Aufhäuser Investment Banking Privatbank AG

The analysts at Hauck & Aufhäuser periodically publish reports on the performance of the CENIT share. The latest reports are available for download below.

Warburg Research GmbH

Warburg Research GmbH, Hermannstraße 9, 20095 Hamburg, www.mmwarburg.de

The analysts at M. M. Warburg periodically publish reports on the performance of the CENIT share. The latest reports are available to download below.

GBC AG

GBC AG, Halderstr. 27, 86150 Augsburg, www.gbc-ag.de

The analysts at GBC AG periodically publish reports on the performance of the CENIT share. The latest reports are available to download below.

Montega AG

Montega AG, Schauenburgerstraße 10, 20095 Hamburg, www.montega.de

The analysts at Montega AG periodically publish reports on the performance of the CENIT share. The latest reports are available to download below.

Bankhaus Metzler

Bankhaus Metzler, Untermainanlage 1, 60329 Frankfurt am Main, www.metzler.com

The analysts at Bankhaus Metzler periodically publish reports on the performance of the CENIT share.

Access to the latest reports can be requested at https://capm-research.metzler.com/en/.

General data

Company: CENIT AG

WKN: 540710

ISIN: DE0005407100

Symbol: CSH

Sector: Software

Accounting Method: IFRS

End of Fiscal Year: December 31st

Management Board: Peter Schneck (CEO), Dr. Johannes Fues (CFO und CtrO)

Supervisory Board: Rainer-Christian Koppitz (Chairman of the Supervisory Board), Regina Weinmann (Deputy Chairman), Laura Schmidt (Employee Representative on the Supervisory Board)

Total Number of Shares: 8,367,758

Free Float: 62% (status: August 2022)

CENIT share initial listing

Project statement on CENIT listing in 1998

Stuttgart-based CENIT is one of the leading medium-sized software firms and service providers for information technology and electronic data processing. The revenues from its listing on 6 May 1998 will, on the one hand, help increase the company's equity-to-asset ratio and, on the other hand, provide solid financing for the continued dynamic growth of CENIT AG in the next two to three years. CENIT's listing on the Neuer Markt segment of the Frankfurt Stock Exchange underlines its pioneering role as a provider of innovative and seminal state-of-the-art technology.

Initial listing: 6 May 1998

Segment: Neuer Markt, Frankfurt

Security Code Number (WKN): 540710

Bookbuilding procedure period: 28–30 April 1998

Bookbuilding range: 100.00 to 125.00 DM

Issue price: 125.00 DM

Issued shares: up to 1,000,000 ordinary shares with a nominal value of 5.00 DM each

Dividend entitlement: for the entire fiscal year 1998

Underwriting syndicate: Baden-Württembergische Bank AG, Bayerische Vereinsbank, DG Bank AG, Dresdner Bank AG